The best AI stock from Japan is Headwaters Co (4011:JP) beating even Nvidia

|

| In 2022 Headwaters announced a cooperation with AI giant Nvidia |

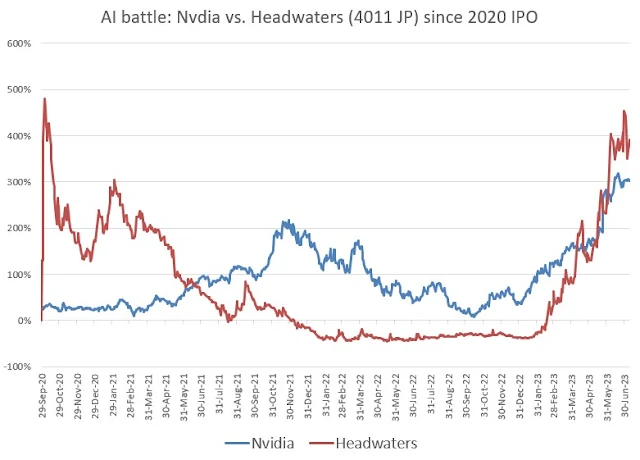

One of the best performing stocks worldwide in 2023 is Headwaters Co from Japan with a gain of 670% in 2023 as of July 10. Headwaters provides artificial intelligence (AI) solutions and is benefiting from the explosive growth for the sector and the hunt for AI-stocks by investors. However the valuation looks very high, certainly when the current 30%+ revenue growth drops to lower levels.

The stock price of Headwaters Co, trading under the symbol 4011 in Japan, has really taken off in 2023 raking in huge gains following the AI hype that was originally started by Chat GPT. Investors have been pushing up AI related stocks, such as Nvidia. However, one of the purest AI players that almost nobody knows of is Headwaters from Japan. As a fun fact, Headwaters announced an AI partnership with Nvidia back in 2022.

The Headwaters slogan on its website is 'Let's go change the world' and this is definitively happening for investors in the stock seeing their net wealth increasing rapidly in 2023 because of the big AI hype. Headwaters went public only a couple of years ago with its IPO dating back to September 29, 2020. The stock price movement was bizarre since, dropping from a 13.500 yen price in 2020 to a fresh low of about 1.500 yen last year.

BATTLE OF THE AI SUPERSTOCKS: Nvidia stock is up 188.6% in 2023 vs. a 670% gain for Headwaters from Japan as of July 11, 2023.

In 2023 the Headwaters Co stock price has come back with a vengence, jumping 670% to the current level of 13.532 yen. The crazy thing is that this matches the highest prices paid by investors just days after the 2020 ipo. It took a long time for the stock to bounce, with a 16.630 yen all time high earlier this month.

|

| In 2023 Japan's AI stock Headwaters has rallied past Nvidia |

Effectively, anyone who bought at the IPO has not made any money yet, even with the stock up this much in 2023. This is not new for Japanese stocks, with many IPOs coming to market at high prices, only to drop to lows in the following years. We have seen this especially with technology IPOs in Japan.

HEADWATERS CO VALUATION AND OUTLOOK

Headwaters Co currently has a market cap of 25.33 billion yen, equal to $179.2 million. This is a small cap in US terms. Headwaters does not yet pay a dividend and analysts expect the a revenue growth of 34% to 2.1 billion yen for FY 2023. Growth will slow down to about 15% annually for 2024 and 2025, what makes the current price/sales ratio of 12 for Headwaters look very high. The estimated p/e ratio now is a whopping 272 for FY 2023, and drops to an expected 202 based on 2024 earnings estimates. This of course is very rich, especially for a company with less than 20/30% annually expected sales growth. But anyhow, Headwaters Co last updated its annual sales forecast on May 15, expecting a 34% growth to the above mentioned 2.11 billion yen. If the company can keep up with this pace of growth the high valuation can be explained better.

Headwaters Co Ltd (4011: JP) from Japan provides artificial intelligence (AI) solutions to companies. "Headwaters" means the source of the flow, the uppermost stream. The company name "Headwaters" was chosen based on the intention to overwhelm Japan's IT industry and revolutionize the industry in the same way that headwaters starts from a drop of water and afterwards becomes a giant flood. Headwaters became a publicly traded company. The biggest shareholder in Headwaters is Yusoke Shinoda with 48,58% of outstanding shares.