Swiss Dividend Aristocrat Roche pays record dividend of CHF 9.50 in 2023

On February 2, 2023, Roche Holding AG, the Swiss pharmaceuticals company, announced a small dividend hike from CHF 9.30 to 9.50 per share. Dividend Aristocrat Roche has raised its dividend for more than 30 consecutive years.

Switzerland is known for its many great dividend paying companies, including pharma giant Roche Holding. Roche, together with peer Novartis and food giant Nestlé are true Dividend Aristocrats in Europe with 25+ consecutive years of dividend growth.

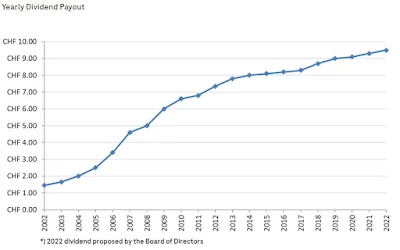

Roche announced a new 2.2% dividend hike to CHF 9.50 per share last week, continuing a great track record with more than 30 consecutive years of dividend growth. The problem with Roche however, is that dividend growth has been slowing since 2013 with a 5 year CAGR for the dividend dropping to just 2.7%. This hardly keeps up with inflation for most European companies, so investors will not be happy with the continued small dividend hikes (see below). Earlier also peer Novartis announced a small dividend hike.

|

| Roche has been raising its dividend for decades (image: Roche website) |

The Roche dividend for FY 2022 will be paid on March 20, 2023, to shareholders of record on March 17, 2023. The dividend of CHF 9.50 per share currently yields 3.4% at a stock price of CHF 282 for Roche. The ex-dividend date will be March 16.

Based on calculations by dividendtrackrecords.com Roche will now pay an estimated €7.7 billion in dividends annually, making it one of the biggest dividend payers in Europe. With a $251 billion market cap Roche currently is one of the biggest European companies and dividend payers and actually pays more annually than biggest European company LVMH (€6 billion in dividends annually). LVMH however cut its dividend because of the covid-pandemic, ending a decades long dividend history.

Roche Holding AG (Roche) is a research-based healthcare company with two division: Pharmaceuticals and Diagnostics. The Pharmaceuticals Division consists of Roche Pharmaceuticals and Chugai. The Diagnostics Division consists of four business areas: Diabetes Care, Molecular Diagnostics, Professional Diagnostics and Tissue Diagnostics. Roche develops medicines for various disease areas, including oncology, immunology, infectious diseases, ophthalmology and neuroscience. Its pharmaceutical products include Anaprox, Avastin, Bactrim, Bondronat, CellCept, Cotellic, Dilatrend, Dormicum, Invirase, Kadcyla, Kytril (Kevatril), Lariam, MabThera, Madopar, Neupogen, Pegasys, Perjeta, Pulmozyme, Rocaltrol, Rocephin and Roferon-A. The Company offers products for researchers, including cell analysis, gene expression, genome sequencing and nucleic acid purification. Roche has been one of the best dividend payers for decades with 30+ consecutive years of dividend growth, making it one of the rare Dividend Aristocrats in Europe.